Edited: Apr 22, 2024

What is food liability insurance?

As a restaurant owner or food business operator, you’re passionate about providing delicious meals and impeccable service to your customers.

Food liability insurance is more than just another expense; it safeguards your business when unforeseen situations arise in your food business, whether you are a caterer, a home chef, own a restaurant or a food truck.

Examples of the type of coverage you may need:

- General Liability Coverage

- Damage To Premises Rented Coverage

- Tools, Equipment, & Inventory Coverage

- Options For Additional Policies & Increased Limits

- Unlimited Additional Insureds

Here’s why it’s important:

Peace of Mind: Running a restaurant or food business is already stressful without the added worry of potential liabilities. Food liability insurance provides peace of mind, allowing you to focus on what you do best – serving delicious food and creating memorable dining experiences for your patrons.

Protection Against Lawsuits: Accidents happen, and unfortunately, in the food industry, they can result in lawsuits. Whether it’s a case of foodborne illness, allergic reactions, or slips and falls on your premises, these incidents can lead to costly legal consequences. Food liability insurance steps in to cover legal fees, settlements, medical expenses and damages, saving your business from financial ruin.

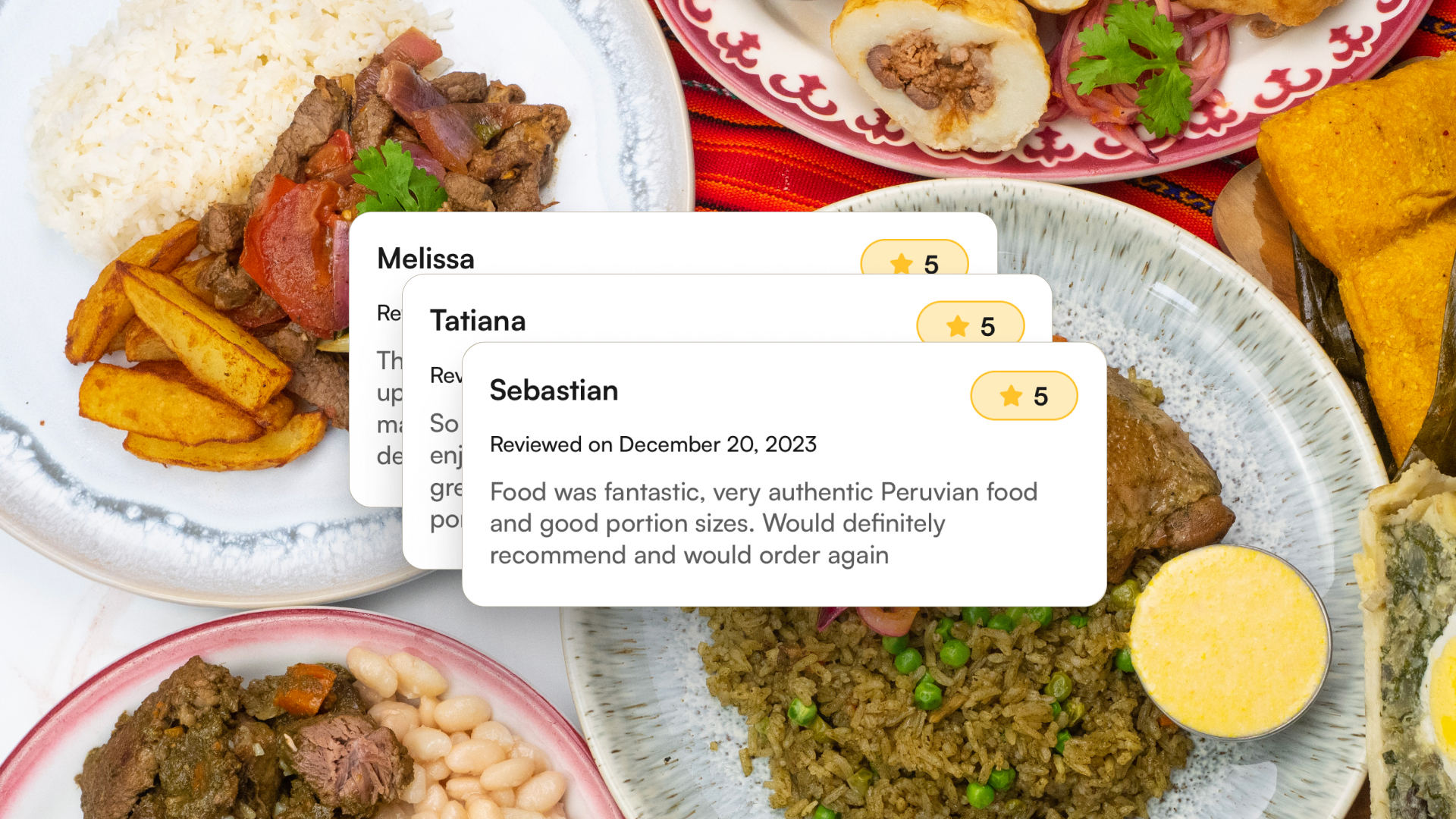

Maintaining Reputation and Trust: A single food safety incident can tarnish your reputation built over years of hard work. With the prevalence of social media, news of such incidents spreads like wildfire, causing irreparable damage to your brand. Food liability insurance helps you respond effectively to crises, mitigate damages, and reassure customers of your commitment to their safety and satisfaction.

Compliance with Regulations: Many jurisdictions require businesses to have liability insurance as part of their licensing and permit requirements. By investing in food liability insurance, you not only protect your business but also ensure compliance with jurisdictional obligations, avoiding fines and penalties.

Protection against Property Damage: If you are operating out of a commercial kitchen space, or rented food truck, food liability insurance can assist with out of pocket expenses.

Tailored Coverage Options: Every food business is unique, facing different risks and challenges. Fortunately, food liability insurance offers customizable coverage options to suit your specific needs. Whether you operate as a caterer, a home chef, a restaurant or a food truck, there’s a policy tailored to protect your interests.

Who needs food liability insurance?

- Food and Beverage Businesses

- Operating out of home or commercial kitchen spaces

- Caterers

- Bakers

- Food Trucks and Mobile Food Vendors

- Food Manufacturers and Processors

- Food Retailers

- Food Service Contractors

- Restaurants

- Event Planners and Venue Operators

3 Steps to get food liability insurance

- Pick the insurance provider and policy that’s right for you

- Purchase the insurance policy

- Make sure to review and renew every year or when it expires

Exclusive offers and partners

Cookin has partnered with the following companies to provide you with pre-negotiated preferred rates and a quick and simple application process.

For chefs powering their business with Cookin in the United States:

With an easy online application and same-day coverage, your home cooking business will be up and running in no time. FLIP makes it easy to shield your business from potentially catastrophic claims with General Liability Insurance, Product Liability Insurance, and other coverage types so you don’t have to worry about paying out-of-pocket when the unexpected happens. Learn more

For cooks and chefs powering their business with Cookin in Canada:

Cookin has partnered with The Chef Alliance to provide you with preferred insurance rates under the Chef Insurance program, $100 off The Chef Alliance membership, access to industry resources and amazing member benefits saving you thousands of dollars each year.

The Chef Alliance is an industry leader, supporting Chefs, Cooks and entrepreneurs with their own insurance policy to help protect them as they grow a successful culinary business.

For chefs exclusively using their own home kitchens in Canada:

Create an account and select “Cookin” from the activity drop down menu in the application. Once a quote has been received and payment has been submitted, an insurance certificate will be instantaneously sent to you by Instant Risk Coverage.

Instant Risk Coverage is a leader in supporting small businesses and has an insurance technology platform that allows you to purchase insurance on your own terms 24/7. You have the flexibility to purchase insurance for a week, a month, several months, or a year depending on how often you intend on cooking on the platform. Learn more